Back in time: Resilience of Myanmar farmers tested as agricultural sector sinks amidst financial crisis

UNOPS-managed LIFT signals rampant weakening coping mechanisms of smallholder farmers producing most of the country’s agricultural outputs.

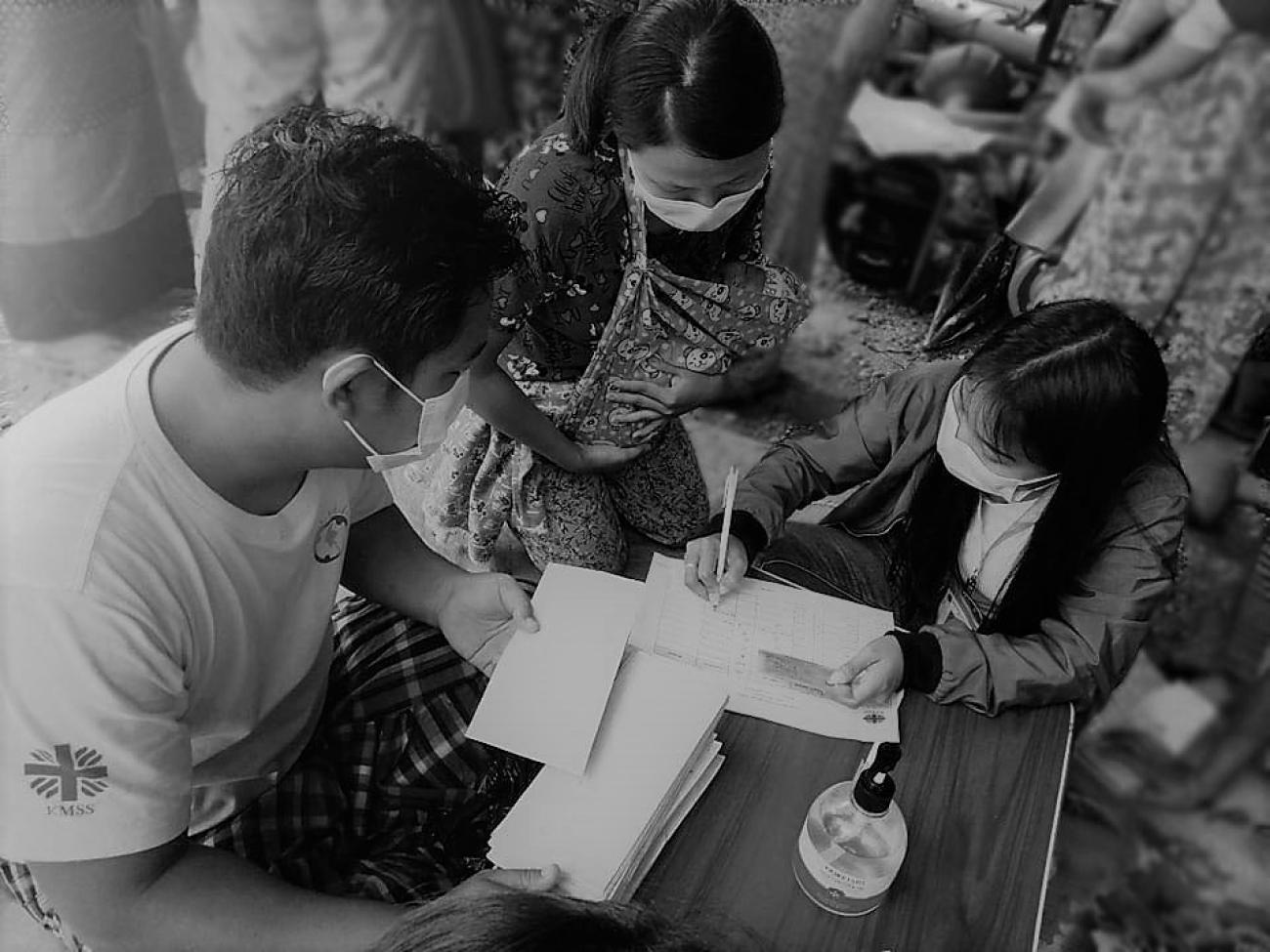

UNOPS-managed Livelihoods and Food Security Fund (LIFT) signals that coping mechanisms of many smallholder farmers, who produce most of the country’s agricultural outputs, have been rampantly weakened and signal a severe threat to rural livelihoods[1]. Following dual crises brought on by COVID-19 and the military’s takeover of government, Myanmar’s financial system is all but paralyzed and is disrupting the country’s agricultural sector.

In the rural economy, an especially important sector for resilience and food security, farm families are squeezed on all sides by lower earnings, higher costs, delayed access to markets, and slow payments for last season’s crops. Landless laborers see fewer jobs and more competition while small rural enterprises struggle to meet the needs of their customers and suppliers.

Disruptions to the agri-food system have been persistent and are becoming more severe. Farmers are investing less in inputs for the 2021 monsoon season due to the higher cost (especially fertilizer) and the uncertainty concerning output markets. At the same time, many smallholder farmers are cash constrained while credit markets for farm input purchases are in disarray due to the mixed signals to farmers about their repayment obligations and the broader ongoing financial system crisis.

The effects are already being felt in lower farmgate prices and higher consumer prices for food, which may pose risks as the main agricultural season, the monsoon season, is underway.

Political crisis obscures the desperation for working capital loans in rural agriculture

Smallholder farmers typically borrow funds at the start of their planting seasons for rice, beans and pulses, and increasingly maize/corn, and repay lenders when crops are sold, generally 5-6 months later. 2021 however has broken the established business cycle.

For the 48-year old mother of seven and a farmer from the Ayeyarwaddy Region, microfinance loans have been a lifeline and a life-changer. A disciplined borrower, she successfully managed three loan products to boost her all-year-round agricultural production and establish businesses such as a grocery store and boat transportation services, which in turn generated employment for ten laborers. The combined effects of COVID-19 and the military takeover have added unexpected strains on Daw Htay Htay Win’s businesses:

"Fertilizer costs have increased almost twofold during this rainy season and my income from the boat transportation, which I used to reinvest in the rainfed paddy season in May and June have shrunken to 30% of what it was before. We are now forced to consume our income and not invest it.”

Without the working capital loans that farmers have come to depend on, farmers economize on fertilizers and other valuable agricultural inputs, lowering their crop yields and incomes. Without extra funds, farmers hire fewer day laborers, creating further distress for landless workers and rural economies.

The challenge is even more acute as all input prices have risen significantly, led by fuel and fertilizers’ prices rocketing due to global oil price increases and a 30-35 percent devaluation of the kyat against the US dollar since the start of 2021.

A 46-year-old single mother of five and a farmer from Mandalay Region, falls behind this sorrow statistics. A member of the microfinance scheme for the last three years, she has been using loans to grow paddy, beans, sesame and betel leaves. The outbreak of the COVID-19 third wave, drought and the unfolding political crisis have affected her production and left her without affordable lending at a time when she needs it most.

"Insecurity and travel restrictions affected my income from selling betel leaves, which we used for family needs. Recent drought and the ever growing costs for fertilizers and other inputs affected my rainfed sesame fields and I’m worried my income will be much lower this year and I will need to borrow more for the next season.”

“Farmers here realize the benefits of borrowing at a relatively cheaper cost of finance from MFIs. They do not want to take informal loans nor make pre-sell arrangements of their crops to brokers whenever possible,” said a farmer and client of MFI in Ye U, located in Sagaing’s rice belt.

While a loan from a microfinance institution normally costs farmers 2.3% per month, informal borrowing typically charges 5% per month, while farmers can pay up to 8-10% of the value of their harvest to brokers who lend them money to help fund planting. Recently, farmers are required to pay for their inputs with cash rather than on credit terms, further straining their resources.

“People in the community try their best not to miss any principal and interest payments as they want MFIs to continue operating in the village,” says the farmer, echoing widespread concerns that the government-operated Myanmar Agricultural Development has halted its credit operations.

As farmers strive for affordable loans, microfinance institutions halt their services over severe operational and funding difficulties

Myanmar’s most reliable rural lenders, microfinance institutions (MFIs), are facing severe disruptions to their businesses – with field staff prevented from coming to work, customers missing scheduled repayments, and troubled local banks trapping MFIs’ funds that otherwise would be repaid to lenders or distributed as local loans or staff salaries.

While both the rural economy and MFIs claw through day-to-day operating challenges, a larger crisis looms if Myanmar’s MFIs go out of business or run out of funds to lend to their estimated 4 million borrowers[2] due to the meltdown of the domestic banking sector and as foreign lenders’ pause on new loans for Myanmar’s financial sector.

Like the rest of the country, MFIs struggle to transact through local banks or get their hands on enough cash - kyat or US dollars - to conduct business normally or repay their offshore loans. Late payments and the drumbeat of bad news from Myanmar has put foreign lenders on high alert.

Unless renewed sources of funding quickly emerge and/or existing obligations are rescheduled, MFIs will be forced to further curtail their lending and unable to assist their vulnerable rural clients who will continue to suffer lower incomes and harder times.

Some MFIs have already started rationing credit, reducing the size of loans to their customers.

“We are coping with serious operational issues, including very limited access to our cash, non-repayment of loans, and new security issues, but what really keeps us awake at night is worrying about how we can refinance our current loans from local banks and international financial institutions as they come due over the next few years,” says the head of funding for one MFI supported by LIFT.

“We certainly don’t want to pull back. But without funding certainty, we’ll have to plan to shrink our loan book and make fewer and smaller loans just when they are needed more than ever by our clients,” the MFI executive explains, highlighting a potential sector-wide retreat in one of Myanmar’s brightest, highest impact sectors.

If MFIs cannot make new loans to customers after they re-pay, non-performing loans are liable to sky-rocket, further jeopardizing MFIs’ financial stability and their capacities to offer affordable funding to agricultural producers.

While most farmers managed to access production inputs for the monsoon season, though of lower quantity and quality, the harvest and post-harvest management of monsoon crops as well as the post-monsoon production season are under threat if no affordable loans are made available.

“As responsible lenders, we have to balance our clients’ needs against those of the institution,” says a manager of a LIFT-funded MFI, which operates in Sagaing and Chin State and heavily supports small-scale farmers and livestock breeders. “But without funding certainty, we can’t be there for them.”

While among the smaller and more rurally-focused MFIs in LIFT’s network, Thitsar Ooyin is taking a typical approach to managing immediate and looming risks.

“The very first step has been to slow our expansion,” explains the MFI manager, “The second is to reduce the size of each loan, and the third is to stop renewing clients, which greatly increases our risks because our clients, especially in these times, are understandably reluctant to repay without faith we will lend to them again - right away”.

LIFT facilitated the development of the microfinance sector to strengthen food systems…

LIFT has been strongly supporting microfinance development in Myanmar, especially in the rural areas , seeing access to finance and fair lending practices as fundamental building blocks for improving rural livelihoods and resilience among households and small businesses.

Since its start in 2012/13, LIFT-supported MFIs have reached nearly half of total individual loans in the country (2.5 million against a total 5.4 million loans), worth 1.4 billion kyats in total (against a nation-wide total of 2.6 billion kyats).

LIFT’s catalytic collaboration with the TCX programme worked to “hedge” the investor’s currency risk for the USD-to-kyat lending kyat to customers. Two rounds of funding in 2017 and 2020 effectively opened up Myanmar's MFI market to global sources of capital and directly supported more than $200 million of loans from foreign funders to Myanmar MFIs.

The vast majority of these loans were made to the rural sector to support the planting seasons, boost innovations and promote mechanisation in agriculture, leading to improved food security. Through direct grants, technical assistance for lenders and regulators alike and the sponsorship of innovative financing schemes, LIFT has helped increase the flow of more reasonably-priced credit to farmers which, in turn, has lowered the cost of essential working capital and led to investments in better seeds, fertilizers and planting techniques that can bring better returns on their seasonal toil.

As responsible MFI lending has steadily replaced higher-priced informal loans, and lessened farmers’ dependence on their suppliers or crop buyers for credit, the overall sector has grown dramatically, reaching otherwise excluded borrowers especially rural women, driving greater financial inclusion, and helping improve rural incomes. While not all MFI lending occurs in rural areas, rural borrowers have become highly reliant on MFI loans to keep planting and harvesting and bolstering their incomes through unpredictable times.

… and remains committed to support financial inclusion to revive agriculture production and boost food security

There is an imminent threat of a reversal in rural lending and direct negative consequences for rural livelihoods and smallholder farmers.

Creating “breathing space” for MFIs to reschedule some of their repayments to lenders is critical, so that lenders and borrowers can cope with new and extraordinary circumstances. This would allow MFIs to restructure outstanding loans and to extend more loans to their clients, particularly smallholder farm farmers, to sustain their livelihoods.

Only through ensuring that borrowers can continue to access essential funds will Myanmar’s MFI sector sustain its remarkable momentum and continue to play a fundamental role in supporting inclusive economic development across the country.

---------------

[1] The economy is expected to contract around 18 percent in Myanmar's 2021 Fiscal Year (Oct. 2020 – Sept. 2021), with damaging implications for lives, livelihoods, poverty and future growth, according to the World Bank's Myanmar Economic Monitor, released on July 23, 2021

[2] Based on an estimated average 1.4 microfinance loans per borrower. Source: Thitsar Works